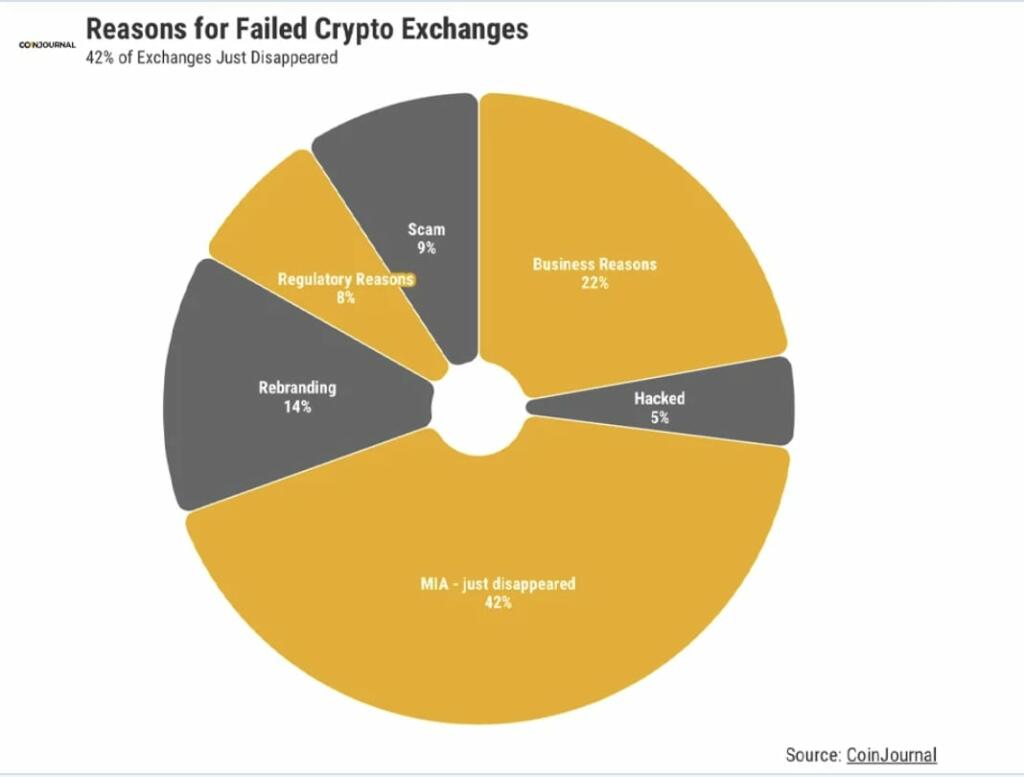

There are many accusations that Cryptocurrency is a complete scam and blockchain-backed technologies are mostly scams. There have clearly been large scams in the area of cryptocurrency.

Crypto companies and exchanges have failed, There has been hacking, theft, and fraud. The algorithmic stablecoin Terra failed last year.

In December 2022, JPMorgan Chase Institute reported that the number of people who transferred funds into a crypto-related account tripled during the pandemic, rose from 3 percent of the population in 2020 to 13 percent in June 2022.

The global financial system has nearly $500 billion in assets. The global financial system is 400-500 times larger than crypto and blockchain.

FTX losses are still be sorted out but are in the range of $8 billion. In 2023, the traditional financial system has seen the failure of Silicon Valley Bank and Signature Bank. First Republic Bank and Credit Suisse have required various bailouts. Over $80 billion of shareholder and bondholder value was lost in the failure of these four banks. There is hundreds of billions of government and other bank support and credit lines.

Signature Bank had become mostly a crypto-related bank. Crypto losses and crypto valuation losses were major factors in Signature’s failure. However, the long-duration bonds and mortgages losses from higher interest rates have been the main factor weakening the global financial system. This caused the most vulnerable and poorly managed banks to fail first.

The absolute value of US and global financial losses are higher in the regular financial system. The percentage of losses and particularly scam and fraud losses are higher with crypto assets and exchanges. However, the current regular banking crisis is still just starting.

Scams, fraud and price crashes are problems with all financial assets and systems.

Managing a Financial System for Stability Instead of Profits for Those Able to Influence Regulations

Canada was the only G-7 country to avoid a financial crisis in 2008, and its recession was milder than those it experienced in the 1980s and early 1990s. For the last six years, the World Economic Forum has ranked Canada first among more than 140 countries in banking stability. It’s not just one-time luck. If you define “financial crisis” as a systemic banking panic — featuring widespread suspensions of deposit withdrawals, bank failures, or government bailouts — the United States has experienced

What’s Different in Canada?

The financial systems of Canada and the United States provide the same basic services. The striking difference is in how they are provided. America has one of the world’s more fragmented financial systems, with almost 7,000 chartered banks and a legion of regulators. Depending on its charter, an American bank can be regulated by the Fed, the Federal Deposit Insurance Corporation, the Office of the Comptroller of the Currency, or state regulators — and that’s just the list for banks. By contrast, Canada has just 80 banks, six of which hold 93 percent of the market share, according to the International Monetary Fund.

Canadian banks solved the bank run problem with no central bank. Scholars have chalked this up to a few things.

1. Canada’s banks were inherently less risky because diversification helped them absorb shocks.

2. Canada’s banks could respond to depositors’ demand for cash by printing their own currency backed by general assets.

3. Canada’s bank system’s high concentration facilitated coordination in emergencies. The Canadian Bankers Association, a private consortium of

banks, established a fund to honor notes issued by failed banks and arranged takeovers of failing banks when our country was enduring the panics of 1893 and 1907. As a result, note holders and depositors rarely experienced losses. Competing banks had an incentive to prevent such losses because, in a highly concentrated banking system, a single failure would be bad for everybody. In exchange for support, they policed each other to prevent excessive risk-taking.

The US Federal deposit insurance, created in 1933, originally applied only to small banks. It was added to the Glass-Steagall Act of 1933 at the last minute to gain support from Henry Steagall, the powerful representative from agrarian Alabama. The Act was the culmination of no fewer than 150 attempts over the previous 50 years at passing a federal deposit insurance system for small banks.

During the Great Depression, the Canadian prime minister launched the Royal Commission on Banking and Currency to consider a central bank. The Bank of Canada was started in 1935. Deposit insurance reduced bank runs in the United States. Deposit insurance wasn’t instated in Canada until 1967. There was very little regulation of the Canadian banking system until 1987. There were two Canadian bank failures in the early 1980s. They were the first bank failures in 60 years. The United States had 79 bank failures in the 1970s alone. The US savings and loan crisis of the 1980s and 1990s was the failure of 32% (1,043 of the 3,234) savings and loan associations (S&Ls) in the United States from 1986 to 1995.

The precursor to OSFI, Canada’s current regulator, had just seven bank examiners in 1980, compared with thousands of examiners in the US. When OSFI was established in 1987, it encompassed most financial activity, including off balance sheet activities.

US financial deregulation moved additional funds out of the banking system. In Canada, the reverse happened; after walls between securities brokerage and banking were removed in 1987, Canada’s banks absorbed securities brokerages, mortgage lending, and other activities.

Shadow banking activities are about 40 percent the size of Canada’s economy, compared with 95 percent in the United States.

The standard mortgage in Canada isn’t the 30-year fixed, as it is in the U.S., but a five-year mortgage amortized over 25 years.

A 1% increase in interest rates reduces the value of a fixed instrument (bond or mortgage) by 1% X fixed years of durction. If that instrument had to be sold to cover a demand for deposits. A 30 year fixed would lose 30% of its value. A five year fixed would lose 5% of its value. Silicon Valley Bank had about $90 billion in ten year mortgage back securities and other ten year fixed instruments.

Financial Problems and the Fall of the Roman Empire

A combination of severe inflation, barbarian invasions, debasement of the currency, civil wars, and destruction of farms, crops and cities all forced administrators to get more taxes from people. Financial problems were a significant part of the fall of the Roman Empire.

20th century Bank Crisis

Panic of 1901, a U.S. economic recession that started a fight for financial control of the Northern Pacific Railway

Panic of 1907, a U.S. economic recession with bank failures

Shōwa Financial Crisis, a 1927 Japanese financial panic that resulted in mass bank failures across the Empire of Japan.

Great Depression, the worst systemic banking crisis of the 20th century

Secondary banking crisis of 1973–1975 in the UK

Japanese asset price bubble (1986–2003)

Savings and loan crisis of the 1980s and 1990s in the U.S.

1988–1992 Norwegian banking crisis

Finnish banking crisis of 1990s

Sweden financial crisis 1990–1994

Rhode Island banking crisis

Peruvian banking crisis of 1992

Venezuelan banking crisis of 1994

1997 Asian financial crisis

Enping financial crisis

1998 collapse of Long-Term Capital Management

1998 Russian financial crisis

1998–2002 Argentine great depression

1998–1999 Ecuador economic crisis

21st century Bank Crisis

2002 Uruguay banking crisis

2003 Myanmar banking crisis

Financial crisis of 2007–2008, including:

Subprime mortgage crisis in the U.S. starting in 2007

2008 United Kingdom bank rescue package

2009 United Kingdom bank rescue package

2008–2009 Belgian financial crisis

2008–2011 Icelandic financial crisis

Great Recession in Russia

2008–2009 Ukrainian financial crisis

2008–2014 Spanish financial crisis

Post-2008 Irish banking crisis

Venezuelan banking crisis of 2009–2010

Ghana banking crisis of 2017–2018

2023 United States banking crisis

2023 global banking crisis[3][4]

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.

It combines puzzle solving with narrative challenges and character development.

In different phrases an journey sport focuses on downside solving fairly than statistics

and fight. Labeling as a result of my most tough downside.

All fiat currencies are scams. Some of them are just slow enough scams that you can get some use out of them before the scammer cashes in.

And when the power goes off and the net goes down?

What is left that is real, of crypto or of the standard monetary system?

The global average cognitive aptitude of humans is falling like a rock. The late unlamented Flynn Effect is proven to be phenotypic rather than genotypic, which means it is history and obsolete before it could have an impact.

Who will put the pieces back together after the inevitable collapse caused by the South Africanization of the developed world?

The biggest problem with Crypto isn’t that it’s a scam or that there is rampant fraud.

The biggest problem is the cost of ‘gas’, that is, the cost to use it. If I have $1 of crypto, but I have to pay $2 to execute a transaction or transfer to another user, then what good is it? Visa/Mastercard only charges 2% to the vendor, but that same transaction using Crypto costs 30% all the way up to 200%.

Research the cost of ‘gas’ to use crypto, whether bitcoin, etherium, cardano, stablecoin, etc.

Always do your due diligence before putting your money into something…

About 21 Million Bitcoin and never another one. Baseball cards, like Bitcoin, have a limited number printed on a worthless piece of paper, never-the-less their rarity gives them value.

When these 21 million Bitcoin are all distributed no new ones will be created. The US dollar will be issued on a worthless piece of paper with an important-looking person on it – ENDLESSLY. I’ll be one of 21 million of earth’s billions to have one, thank you.

j

Is crypto a scam? I don’t know if it is a scam but it is almost definitely massively overvalued. Crypto is intended to be a currency but almost no one uses it as that. No one would quote you a price for something in bitcoin except as a speculative enterprise (imagine the issues with getting a quote in BTC to build a house).

If people don’t use crypto as currency, generally – what is left that can provide value from it? It just functions as an investment that you invest in because you think it will go up in value. It doesn’t produce a product or service that could become more desired or efficient.

Exactly…

The short answer (to the title questions … is crypto and the whole financial systems a collective scam?) is NO.

They are both best described as earned-return systems. Crypto is more like gold mining, in that the early ‘deposits’ are relatively easy to mine electronically, but become ever more difficult computationally and energy-investment wise, as more tokens are discovered.

Note, I use ‘discovered’. Like gold. Because the algorithms that test ‘the next possible chunk of math’ are designed not to be circumvented by ‘cheaters’. The math MUST be executed, to the required precision, with all the required steps, to turn a range of chunks into ‘is it a crypto token?’ solutions. Change even one bit in the ten-thousand bit seed, and the results become wildly different, and fail the it-is-a-crypto-token test.

The best explanation I read once (for BitCoin) was that initially it required that the last 30 digits of the computed test be all-zeros. If you ‘found one’, you would publish it for independent testing (and registering it as ‘yours’), and anyone interesting in purchasing it from you could confirm that yes, indeed, there are 30 zero’s in the last position. Independent validity evaluation. Really awesome! To make it harder over time, MORE ZEROS were required for each ‘mountain of crypto space’ that would be mined.

Each zero added 10× the computational overhead roughly. By 40 zeros, the computations would be billions of times harder than at 30 zeros.

________________________________________

Independently, at least with most sovereign currency financial systems, a different method is used to create new money: sale of, and gradual pay-off of the sovereign’s Central Bank treasury notes. The sovereign can NOT just crank up the printing presses and ‘create’ new money anytime it believes it needs more. No.

Instead, through deficit spending (though not exclusively) — which is to say overspending the sovereign’s taxation base — sovereign treasury notes ARE cranked out and in America’s case, sold to an OPEN MARKET at a blôody auction. Yep. If you’re buying them, you don’t have to pay full price. If the sovereign’s economy is in the shîtter, you aren’t inclined to pay full price at all. A discount equalizes things: the interest coupons are WORTH MORE than they would be at face value! However, other buyers are perhaps eager to get the increased returns, so tend to jack up the auction price. Which in turn lowers the returns.

Where does it end? When the pack of bonds interested buyers fail to raise the auction price. The winner shells over whatever the auction ended at, takes away the paper, and for the next 1-to–30 years starts clipping interest coupons and redeeming them for cold hard cash at any bank, anywhere. Once a quarter.

Now the key trick is to understand that it is the COUPON exchange that creates the NEW MONEY. At least until America’s(and quite a few other countries) dalliance with so-called quantitative easing (which is the preëmptive buy-back of bonds that have NOT matured!) the situation was mind-numbingly stable. Couldn’t invent new money except by way of the trillions of short-to-long term treasury bonds, which ever-so-slowly injected brand new money into the economy every quarter.

This mechanism was designed to be doubly secure against financial collapses and hyper-inflation. If the sovereign’s pölïtical leaders feel inspired to inject a LOT of money into the economy, it comes at an automatic price … of bond buyers getting cold feet about the SECURITY and PRUDENCE of the central banks’ rise in credit expenditures, and thus dropping the settle-price on bonds. raising their effective interest. Requiring all banks to offer higher interest on nominal deposits. And catching long-term investors … like Silicon Valley Bank … in a pinch, where when they need to cash in a lot of bonds, suddenly they’re in a competitive buyer’s market, with markedly depressed sale prices. Eroding whatever reserves they thought they were protecting through investment in bonds, to begin with.

And of course, the opposite is true. That when the taxation monies are more-than-sufficient to pay the sovereign’s expenditures, investments and debts … then the sovereign doesn’t really have a financial moral authority to gin up a bunch more bonds. So, the Tuesday auction is bleak. Tiny stacks of bonds. The financial institutional investors clamor over themselves to buy the paper, raising the bond prices markedly. Conversely, in so doing, the bond pay-back interest declines. It can even go negative.

Lastly, the pooh-bahs at the Central Bank economics policy setting meetings decide in turn whether to ‘adjust interest’ of the printed bonds to meet market conditions, or not. By printing bonds with higher face value coupon interest, the auction calms down, and buyers are less likely to jack up their bids. In turn, banks are put on notice that they too need to deliver higher interest to depositors, since collectively large investors can just as easily buy bonds at auction, as deposit their monies at banks.

The “SVB Squeeze” is the only upside risk, in the end. Needing to sell off one’s bonds to the market, for whatever the market will bear … when rates have been going sky-high. The buy back is at a fraction of the original price. Sad days.

Does this imply that the West’s financial transparency system is a shell game, or a scam, at the end? Absolutely NOT. There is nothing fairer than an open auction. No buyer is compelled to buy a bond at any price other than what her risk-versus-return guidance has been cued to. In times of inflation, buyers want higher “keep up with the economy” returns. Its that simple. And nothing will compel them to over-pay for a bond at auction. Likewise, in times of very-very-low bond interest, the clamoring of buyers overpays for open market bonds. The buyers WILL pay more, just to get an instrument to park their funds, even at zero-or-modestly-negative interest, especially when the banks’ account rates are terrible. No one forces them to accept the auction well above face value … but they do. Not the Fed, the Banks, the Central Bank Committee, not the President, Congress, their dottering retirement depositors. No one, except their own internal guidance.

And that nominally creates a stable, slow-to-change interest and inflation environment.

What has rather predictably ‘gone down’ is that the scatter-brained Administration imposed business-and-commerce thwarting lock-downs on a huge swath of the American economy, then tried to ‘band-aid’ fix it by injecting enormous piles of ‘free money’ directly to the citizen base. Even from Econ–101 (which at university isn’t very sophisticated), you could predict that INFLATION of the money supply would be a direct, undesired result. And from that, depreciation of the buying power of The Dollar. Which looked to upend the economy ‘bigly’, ruining the chances that the in-power Democratic party would be able to hold Congress and the Executive branches. OH NOES!!! Spend more anyway! Market it as prudent monetary policy! Inject more! … and because of how it work, AUCTION way, way, way more bonds. Depressing their price, driving up interest, and catching SVB in The Squeeze.

IF you read all that, I salute you. It turns out to be surprisingly true and accurate. I learned it from a budding economist at UC Berkeley in the 1970s, who went on to win the Nobel for his remarkably clear-and-forward thinking whole-economy dynamics theories. They’re apparently still at work. Poor SVB.

Warren Buffet, the most succesful investor in the world, said if he could buy all the Bitcoin in the world, he wouldnt pay more than $25 for it. Its only value lies in the hope you can sell it on to someone else for more than you bought it for, and nothing else. That is why there is so much hype based on what seems like nonsense or false promises.

Image a smart agent that provide services to other agents for money. It also retrain itself by buying computing resources and premium data from other agents. Should the agent use a bank account, a credit card or a cryptocurrency wallet? I bet a cryptocurrency wallet is the best choice.

There are some very basic flaws with the financial system, based on my decade plus learning, teaching, writing about it:

1. There is not a clear understanding of the role of Land – which in classical economics meant ALL of nature’s resources, not just physical Terra Firma – as fundamentally different from Capital. The former is nature-made, finite, and generally appreciates in value while Capital is manmade, infinite though constrained by human and natural resource (Land) limits, and generally depreciates in value through obsolescence and wearing out. The conflation of Capital with Land leads to speculation and bubbles instead of proper taxation on the use/abuse (pollution) of Land, and the untaxation on Capital in order to encourage production of more of it for human needs and wants.

2. Money is not finite and it is not Capital either. It is a store of value, a medium of exchange. A monetarily sovereign government like the U.S. can produce infinite amounts of money. It cannot create more natural or human resources, though it can use them better and more efficiently; the tax system can help a lot with that.

3. Cheap, widely available energy is the foundation for the industrial revolution and the current standard of living, more important than the machines that run from it, AI, the internet, computers, cars, etc. They all depend on cheap energy. Most of human history had no better energy than wood fires and the horse. When coal, then oil, was put into broad use, the industrial revolution exploded upwards.

4. There are ample pools of money and most of the financialized world is engaged in rent-seeking, not efficient allocation of money. For example, if the >$100 trillion in public (not counting private) U.S. pension funds were cashed in, and pensioners were just paid out of taxes with COLAs, forever, it would free up so much money for states, counties, cities, etc. that virtually all of them would be forever in the black, poverty could be eliminated (corruption is a persistent obstacle to that everywhere, another problem), infrastructure rebuilt and the economy grown by up to double its current rate without inflation (an army of financiers could get more socially productive jobs to help with this, along with AI). 95%-100% of pension funds are rolled over, every year, net of fees, while employer/employee contributions plus periodic multi billion dollar cash infusions are made by states, counties, cities etc. whenever the “market” crashes and the projected ROI won’t be enough – supposedly (these calculations are made by the same crooks managing the funds) – to cover future payouts. Cashing in the pension funds would immediately lift the credit ratings of all entities that own them (in an honest world), enable debts to be paid off or lower interest rates on them, and even allow for modest tax cuts overall.

5. Alternate currencies CAN work, but cryptocurrencies are based on nothing, not even scarcity since in aggregate they can be created at whim, infinitely, with nothing behind them except minor labor to create and maintain them. They were a Ponzi scheme form the beginning, with hacking, thefts, and subscams all along the way, and no cure for that except to normalize them into the financial system, which will show them to be pointless to begin with (they can barely be used in transactions and not for paying taxes either).

There is nothing wrong with the Financial System.

There is everything wrong with the people that inhabit that financial system; they are fundamentally lazy, greedy, and stupid; but mostly not evil – at least in the rich world.

At least 50% of people want to be in the top 10% of wealth and income without wanting to undertake the effort, focus, and commitment of those activities most likely to achieve that, such as advanced STEM careers and 40- to 60-hr work-weeks. They know the paths most likely to achieve those results and they emphatically avoid them, even touting their limited success when doing so.

The financial system – at least in rich countries- is the ultimate compromise of such people – allowing risk-taking and other such short-cut/ speculative/ cronyist behaviours to at least play a part in the economy, otherwise they go to crime or poverty-depression.

Quality people start at an early age – raise them right and they will pursue effort-driven and smart-focussed success. Add in incentivization, quality apprenticeship/internship, and a reduced burden of techno-regulation/litigation and ESG-related over-reach and you have a mutually-reinforcing success-growth providing an economic distribution that is top-heavy mushroom rather than bell-curve.

Easier said than done.

Many autocracies and communalist systems tried to create their own hyper-meritocratic society. Exclusive and accelerated education, skill, and achievement programs for the few that could be motivated and supported based on resources at the time. Why did the soviet union really fail post-1950s? A bit too early for its time based on insufficient communications and control infrastructure? If a 2023-AI had been put in charge of that, with current tech and access to local basic resources, would it have succeeded? Was the gap too big (and too expensive) between the proletariat and ‘chosen’ therefore under-funding the real production needed to keep a system afloat. Shame to have a top-notch space system but a starving populace.

So is the quality of the system proportionate to the number of people that can access (and use effectively) its best education, assuming they are worthy? I started my engineering education in a near-ivy Uni school, finished that freshman year top of my class, but couldn’t afford to continue – so went to a public institution, did well, but felt unchallenged – even less motivated. Alma mater matters.

Is startup a scam? No, it’s a high risk investment and there are lots of cheats, frauds but still there are many honest players. Cryptocurrency is similar to startup but it’s even a higher risk investment and has a lot more cheats and fraud but it’s still not a scam.

Startups have the possibility of crteating a prioduct that can generate wealth. Crypto is more like art, it can’t feed you, you can’t make things with it, the price is driven by whim, scarcity and fashion.

We make it too easy for executive management to benefit form planned bankruptcies. Executive management should not be rewarded for stock price but for in creasing market cap. The two are not the same thing.

Interesting partial history of finance. It would appear that the US financial system is (by design?) prone to more volatile cycles than Canada’s.

It is also interesting to me how much of finance is ephemeral, only existing as a consensual extension of people’s minds. A reality none the less.