Silicide materials cost 100 times less and some can still get a ZT of over 1. Previously it was believed that major commercialization would not happen until ZTs were reached a 3.

Interest in thermoelectrics for waste-heat recovery and localized cooling has flourished in recent years, but questions about cost and scalability remain unanswered. This work investigates the fabrication costs and coupled thermal and electrical transport factors that govern device efficiency and commercial feasibility of the most promising thermoelectric materials. For 30 bulk and thin film thermoelectric mate rials, we quantify the tradeoff between efficiency and cost considering electrical and thermal transport at the system level, raw material prices, system component costs, and estimated manufacturing costs. This work neglects the cost of heat, as appropriate for most waste-heat recovery applications, and applies a power generation cost metric in $/W and a cooling operating cost metric in $/kWh. The results indicate material costs are too high for typical thermoelectric power generation applications at mean temperatures below 135 C. Above 275 C, many bulk thermoelectric materials can achieve costs below $1/W. The major barrier to economical thermoelectric power generation at these higher temperatures results from system costs for heat exchangers and ceramic plates. For cooling applications, we find that several thermoelectric materials can be cost competitive and commercially promising.

Novel nanowire and superlattice materials have the potential to have a low $/W value if improvements in ZT are made above what is reported, but with the currently reported values they are not competitive in the near-term due to the large costs associated with microfabrication/ MBE manufacturing techniques.

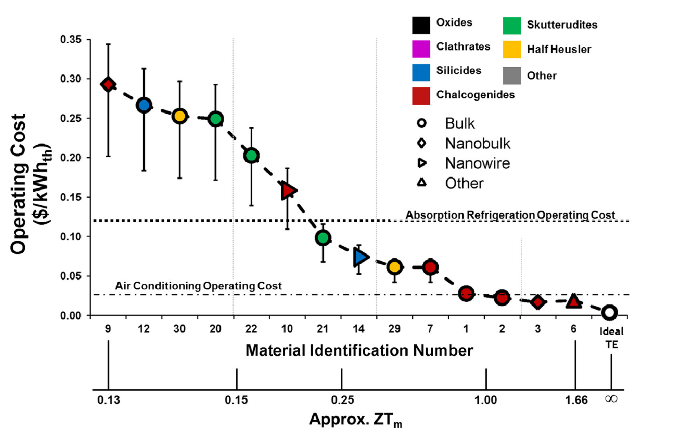

Operating costs of a thermoelectric cooler for various materials. Colors represent material class; shapes represent material structure resulting from different manufacturing techniques. The materials are organized from left to right in order of increasing ZT m . The error bars represent the variability in electricity price with the average at 9.83 cents/kWh e . The lower bound is for industrial applications with an electricity cost of 6.77 cents/kWhe , and the upper bound is for residential applications with an electricity cost of 11.54 cents/kWh e . In this analysis F ¼ 1 and the heat exchanger costs are neglected. In the ideal TE, the material is completely free and ZT m ¼1 ; this is equivalent to a Carnot refrigerator operating with only the cost of electricity being signi fi cant, giving 0.24 – 0.41 cents/kWh th . (For interpretation of the references to color in this figure caption, the reader is referred to the web version of this paper.

Alphabet Energy has a Turnkey Thermoelectric generator and they are targeting some industrial markets

Alphabet Energy currently offers the only turnkey thermoelectric generators for waste-heat recovery. Our generator systems are designed to meet the demands and conditions our customers require, such as harsh temperatures, 24/7 operation, and remote operation.

Because thermoelectrics are steady state, our generator products require no engine modifications, no working or compressor fluids, and require virtually no maintenance. This makes them ideally suited for remote applications where fuel is expensive or limited or where energy efficiency is highly valued. The simplicity in their design means they only have two points of connection, can be installed in two hours, and are easily transportable.

Phononic Commercial Consumer Devices

The near-term applications for Phononic’s science are high-end refrigeration for labs and medical facilities, as well as cooling for fiber optics and data servers that are “necessary to continue Moore’s law,” according to the company. Phononic is looking to develop thermal management technology for consumer devices, and, more strikingly, to replace cheap, ubiquitous and century-old incumbent compressor technology.

Phononic has also been interested in using their thermoelectrics for consumer-focused devices. It has developed a solid-state heat pump out of its materials and it is using it in compressor-free refrigeration units, like super-quiet fridges and home wine chillers. The company says it intends for its technology to be used in refrigeration consumer products that are “quiet, energy efficient, toxin-free and require no moving parts.”

Phononic is building out a 20,000 square feet of manufacturing in Durham, North Carolina, and is looking at Asia as a big market for its goods.

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.