The US economy still faces six daunting headwinds that will limit future potential growth and hold it below the pace which innovation would otherwise make possible.

The slowdown in growth already takes into account the first two headwinds.

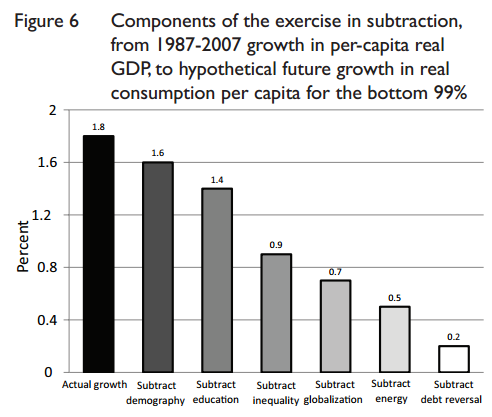

1. The “demographic dividend” is now in reverse motion. The original dividend was another one-time-only event, the movement of females into the labor force between 1965 and 1990, which raised hours per capita and allowed real per-capita real GDP to grow faster than output per hour. But now the baby boomers are retiring, no longer included in the tally of total hours of work but still included in the population. Thus hours per capita are now declining, and any tendency for life expectancy to grow relative to the average retirement age will further augment this headwind. By definition, whenever hours per capita decline, then output per capita must grow more slowly than productivity.

2. The second headwind already taken into account in the 2007-27 forecast is the plateau in educational attainment in the US reached more than 20 years ago, as highlighted in the path-breaking work of Claudia Golden and Lawrence Katz (2008). The US is steadily slipping down the international league tables in the percentage of its population of a given age which has completed higher education. This combines several problems. One is the cost disease in higher education, that is, the rapid increase in the price of college tuition relative to the prices of other goods. This cost inflation in turn leads to mounting student debt, which is increasingly distorting career choices and deterring low-income people from going to college at all. Not everybody gets a scholarship.

3. The most important quantitatively in holding down the growth of our future income is rising inequality. The growth in median real income has been substantially slower than all of these growth rates of average per-capita income discussed thus far.

4. The interaction between globalisation and ICT is a daunting headwind. Its effects include outsourcing of all types, from call centres to radiologist jobs. Foreign inexpensive labor competes with American labour not

just through outsourcing, but also through imports.

5. Energy and the environment represent the fifth headwind. The consensus recommendation of economists to impose a carbon tax in order to push American gasoline prices up toward European levels will reduce the amount that households

have left over to spend on everything else.

6. The twin household and government deficits represent the final headwind.

If you liked this article, please give it a quick review on ycombinator or StumbleUpon. Thanks

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.