Wall Street Journal – Will China’s property bubble trigger a financial crisis? Concern is high this year thanks to deteriorating sales figures and reports of large price cuts. But China really is different. Though a correction is coming, the consequences will be more manageable than common sense might suggest.

This information was written by Mr. Huang. He is a senior associate at the Carnegie Endowment for International Peace and a former country director for the World Bank in China.

No real property market existed in China until housing was privatized more than a decade ago. Then came the 2008 global financial crisis and Beijing’s credit expansion, after which Chinese land prices surged five-fold, triggering commensurate increases in property prices and other asset values. In other words, the market was trying to establish appropriate prices for an asset whose value was previously hidden by socialist fiat (a pattern also seen a decade ago in Russia).

Instead of a bubble, therefore, China’s sharp property-price increases could represent the real value of land in a densely populated country. If so, they would signal the Chinese economy’s financial deepening, not the imminent onset of a financial collapse.

A main concern is that China has allowed housing construction to outpace requirements, especially in second- and third-tier cities, so prices will fall. But the correction may not be destabilizing because long-term trends in Chinese property prices don’t fit the typical pattern of a bubble.

China’s property market has seen cyclical downturns followed by rebounds, most recently when housing prices started falling in late 2011 and then turned upward again in the second half of 2012. It is hard to find past bubbles that experienced such significant and persistent price declines before reversing and continuing to inflate. When prices start falling in a bubble situation, investors typically rush for the door and cause a collapse.

That China’s property market saw no such collapse in 2012 suggests that its high prices were supported by more than “irrational exuberance” and may be a reasonable floor—implying, in turn, that today’s prices may fall by about 20% over the coming year but not more than 30%.

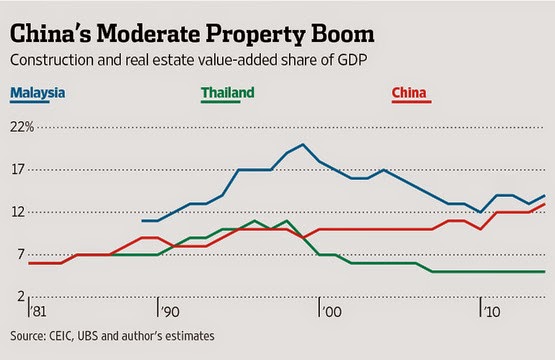

Still, scaling back property construction will have a negative impact on growth. Construction and real estate have been gradually rising as a share of economic activity for three decades and today account for 13% of GDP. Contraction there will slow growth and have ripple effects on related industries.

Estimates of China’s excess property stock suggest that construction volume will fall by roughly 10%, subtracting two to three percentage points from GDP growth. Yet the full impact of the correction on GDP growth is likely to be spread out over several years. If uncompensated by other infrastructure investments, it could cause growth to fall toward 6% in the next year or two—but darker scenarios, in which growth collapses to 5% or less, are highly improbable.

Many China bears are nevertheless convinced that the only thing that has kept China’s growth so high in recent years is the even faster growth of credit, and that eventually a credit curb will cause a sharp economic contraction. That pessimism isn’t warranted given the link between credit expansion, property-price increases and GDP growth.

The credit expansion that has supported increases in property prices doesn’t contribute to GDP growth but is reflected in China’s increased fixed asset investment—which is why China’s debt-to-GDP ratio has surged in recent years. But this increase is only a problem if rising asset values aren’t sustainable. Rising debt-to-GDP isn’t a problem if, despite whatever credit was wasted, the bulk of it was used productively.

If you liked this article, please give it a quick review on ycombinator or StumbleUpon. Thanks

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.