In December 2012, first concrete was poured for the HTR-PM demonstration power plant, a 200 MW commercial demonstration plant based on the HTR-10. The small HTR-PM units with pebble bed fuel and helium coolant are 2×105 MWe reactors, so that they can retain the same core configuration as the prototype HTR-10. The twin units, each with a single steam generator, will drive a single steam turbine.

As of the end of 2013, the civil work for the underground part of nuclear island buildings had been completed. The main components, including reactor pressure vessels, core internals and steam generators are being fabricated by domestic manufacturers. A fuel factory that will supply 300,000 fuel elements each year to the HTR-PM is also being built in northern China. According to the project schedule HTR-PM is expected to be commissioned in 2017.

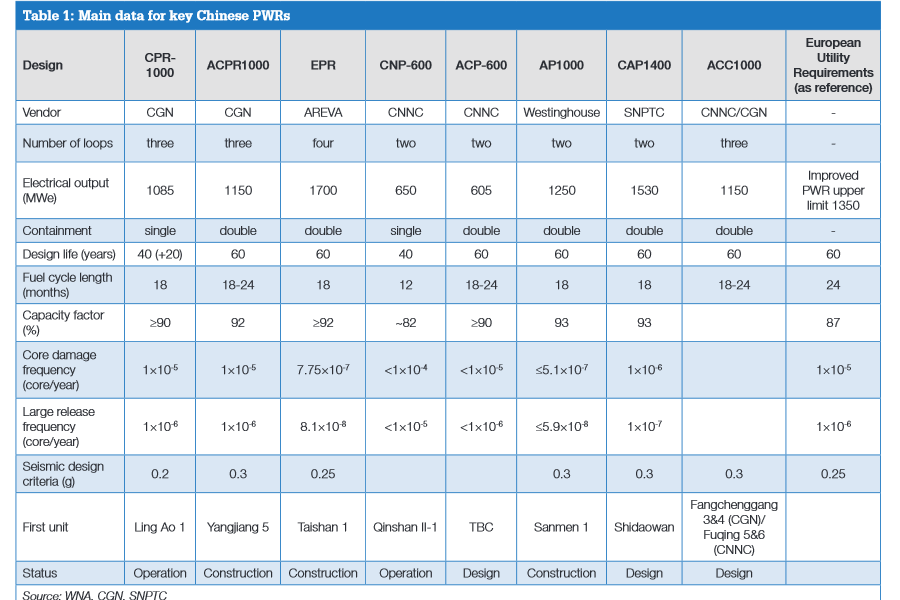

AP1000s are expected to constitute the main part of the Chinese domestic programme (for now at least). The other mainstay of the Chinese programme will be the ACC1000, which is the outcome of the battle between CNNC and CGN for the Chinese Gen III-qualified 1000 MW unit.”

As the ACC1000 design is derived in part from the French M310s at Daya Bay and Ling Ao Phase I, it is believed that it cannot be exported due to French intellectual property concerns. But Kidd says the ACC1000 is expected to remain very important within China, and can be built far more cheaply than the AP1000 until the latter’s localisation rate is much higher.

With respect to Chinese high-temperature reactor (HTR) technology, the goal is eventually to export the HTR-PM design with independent IP rights. However, since existing Gen III reactor lifetimes could be as long as 60 years, the HTR will be at most a supplement to the domestic market in the next several decades.

China is investing in small modular reactor R&D programmes in order to be prepared for a potential international market. However, the nature of China’s electricity demands and geography mean SMRs will not play a significant role in China in the near future.

China’s Fast Neutron and Breeder Reactors

A 1000 MWe Chinese prototype fast reactor (CDFR) based on CEFR is envisaged with construction start in 2017 and commissioning as the next step in CIAE’s program. This will be a 3-loop 2500 MWt pool-type, use MOX fuel with average 66 GWd/t burn-up, run at 544°C, have breeding ratio 1.2, with 316 core fuel assemblies and 255 blanket ones, and a 40-year life. This is CIAE’s “project one” CDFR. It will have active and passive shutdown systems and passive decay heat removal. This may be developed into a CCFR of about the same size by 2030, using MOX + actinide or metal + actinide fuel. MOX is seen only as an interim fuel, the target arrangement is metal fuel in closed cycle.

However, in October 2009 an agreement was signed with Russia’s Atomstroyexport to start pre-project and design works for a commercial nuclear power plant with two BN-800 reactors in China, referred to by CIAE as ‘project 2’ Chinese Demonstration Fast Reactors (CDFR) – in China, with construction to start in 2013 and commissioning 2018-19. These would be similar to the OKBM Afrikantov design being built at Beloyarsk 4 and due to start up in 2012. In contrast to the intention in Russia, these will use ceramic MOX fuel pellets. The project is expected to lead to bilateral cooperation of fuel cycles for fast reactors.

The CIAE’s CDFR 1000 is to be followed by a 1200 MWe CDFBR by about 2028, conforming to Gen IV criteria. This will have U-Pu-Zr fuel with 120 GWd/t burn-up and breeding ratio of 1.5, or less with minor actinide and long-lived fission product recycle.

CIAE projections show fast reactors progressively increasing from 2020 to at least 200 GWe by 2050, and 1400 GWe by 2100.

If you liked this article, please give it a quick review on ycombinator or StumbleUpon. Thanks

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.