Delinquency rates improved for most loan types in 2013Q4. As of December 31, 7.1% of outstanding debt was in some stage of delinquency, compared with 7.4% in 2013Q3. About $820 billion of debt is delinquent, with$580 billion seriously delinquent (at least 90 days late or “severely derogatory”).

Delinquency transition rates for current mortgage accounts are near pre-crisis levels, with 1.48% of current mortgage balances transitioning into delinquency. The rate of transition from early (30-60 days) into serious (90 days or more) delinquency dropped, to 20.9%, while the cure rate–the share of balances that transitioned from 30-60 days delinquent to current–improved slightly ,rising to 26.9%.

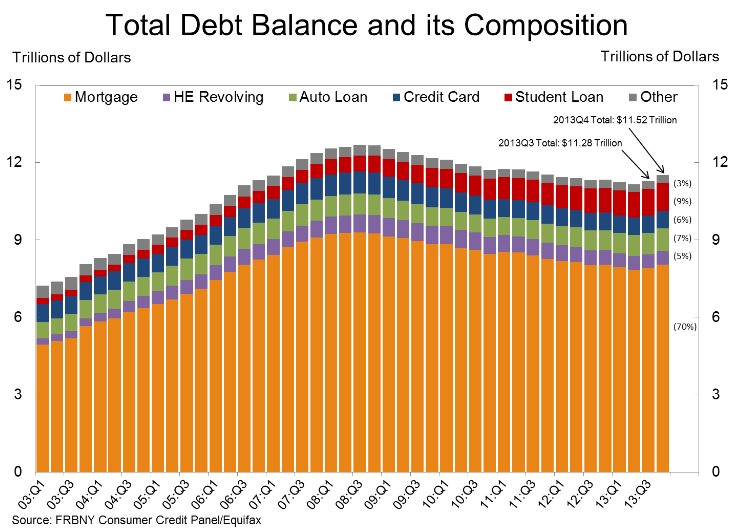

Mortgage debt is $8.58 trillion which is about 8 times the student loan debt of $1.08 trillion.

If you liked this article, please give it a quick review on ycombinator or StumbleUpon. Thanks

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.