The UK Telegraph has an article by Ambrose Evans Pritchard which collects doubts that China economy as measured by nominal GDP and even PPP GDP will surpass the United States this century. All of the statements are just collections of maybe China’s economy will have big problems.

* Maybe China has a debt that is double its GDP

* Maybe China’s aging population will mess up growth

* Maybe the US will resurge to 3% GDP growth on a consistent basis

* Maybe China will slow next year to 7% GDP growth and to 6% by 2020 or even to 3%

* Maybe China will get caught in a middle income trap

* Maybe this will be another American century

* Maybe China’s pollution and environmental problems will choke growth

* Maybe the GDP numbers are false and inflated

* GDP as a measure is flawed because the pollution generation is counted as positive GDP

* Maybe China will have a banking bust

* If China passes the US they will have used too much credit and investment to do it and then will have a bigger bust afterwards (at some point)

* There was also some implied symbolic overall meaning to the delay in authorizing the 220 story skyscraper

I predict the 220 story Broad Group skyscraper will be built by the end of 2014. I predict that 100 story Broad Group skyscrapers will be built by the end of September 2013.

This is a collection of the usual anti-China doubts and it is stated with no firm predictions or substance.

Ambrose Evans-Pritchard is the international business editor of the Daily Telegraph. He is a long-time opponent of the EU’s constitution and monetary union, he was the Europe correspondent in Brussels for the Telegraph from 1999 to 2004. During his time as the Sunday Telegraph’s Washington bureau chief in the early 1990s, Evans-Pritchard became known for his controversial stories about President Clinton, the 1993 death of Vincent Foster, and the 1995 Oklahoma City bombing.

There are several articles about more challenges for China’s economy.

The Globalist has a three part article by George Magnus. Magnus predicts the slowdown in China’s sustainable growth rate may be only half competed. From 7.5-8% currently, it will most likely decelerate further to 4-5% over the coming decade.

Magnus predicts a slowdown for all of Asia because of China radically shifting out of investment:

Magnus – China’s own economic performance may be less robust than is widely assumed. If China’s investment share in GDP slides back by, say, 10% to “only” 40% by 2020 (from the current 50% share), this will have very direct consequences for the rest of Asia. The cost to growth, according to the IMF, could be about 1-2% of GDP in the Philippines and Indonesia, 4-6% of GDP in Malaysia, Korea and Thailand, and 10% in Taiwan.

India isn’t going to be a game-changer for Asia. After a short-lived 10% growth burst in 2010-11, India’s growth has halved. The demographic dividend will only accrue if India can raise its game significantly on the job creation front.

He cites Krugman who uses PPP GDP. Magnus is claiming that China will stall out at per capita PPP GDP of $15000 or a overall GDP PPP of $21 trillion.

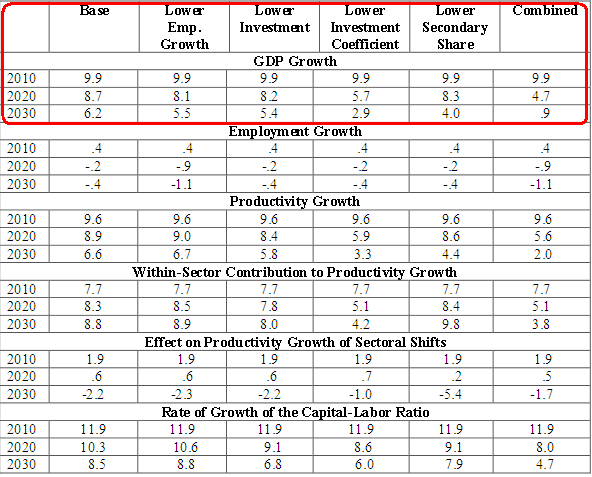

I have predicted since 2006 a slowdown in China’s GDP growth 8% GDP now and 7.0% and possibly 6.5% GDP growth later in the 2020s. Basically the base case from the Federal reserve analysis.

Magnus cites the middle income trap and an article by Krugman about the myth of the Asian Miracle.

Krugman wrote that the four Tiger economies of Asia were paper tigers.

Krugman wrote about PPP GDP for China.

Krugman – World Bank estimates that the Chinese economy is currently about 40 percent as large as that of the United States. Suppose that the U. S. economy continues to grow at 2.5 percent each year. If China can continue to grow at 10 percent annually. by the year 2010 its economy will be a third larger than ours. But if Chinese growth is only a more realistic 7 percent, its GDP will be only 82 percent of that of the United States.

The World bank dropped China’s PPP GDP by 40% in 2005 based on a flawed pricing study.

The 2011 World bank PPP GDP numbers.

United States 15.0 Trillion China 11.3 trillion (without 40% reduction GDP is 15.8 trillion PPP)

It fell in between the strawman of perpetual 10% GDP growth and 7.0% GDP growth. 105% of US GDP on a PPP pre-2005 basis calculation.

Singapore, Hong Kong, Taiwan and South Korea have all done fine in terms of continued growth and achieving highly developed country per capita GDP.

Japan’s slowdown of the last 20-30 years has been at a per capita GDP of a highly developed country.

I am not as much a China optimist as the doubters charicture where China grows at 10% forever.

However, on the PPP GDP basis I am expecting a correction to the numbers to reflect proper pricing across China. On the corrected basis I believe that China is already at about 130% of US GDP on a PPP basis. I expect China to mostly have 7.0-8.5% GDP growth until 2020. I expect about 6.7-7.2% GDP growth through the 2020s with maybe two 6.0% GDP growth years.

* Middle income trap not effecting China

* Debt, pollution, aging not crippling China’s economic growth before 2030. Pollution situation will improve.

* The entire world will manage aging better than currently expected due to automation and improved medicine for healthier older people.

* Urbanization will continue with Hukou reform and stronger social program support

* Strong improvements in universities in China

* no crippling banking crisis for China.

If you liked this article, please give it a quick review on ycombinator or StumbleUpon. Thanks

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.