Cost and performance of EV batteries (March 2012, 100 pages)

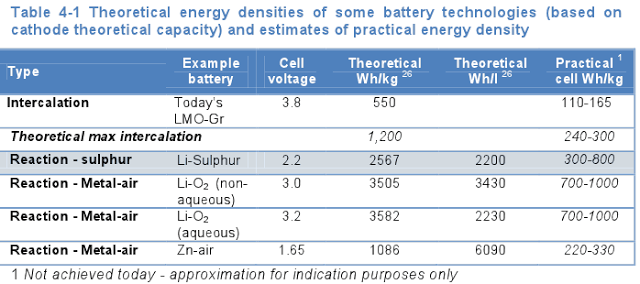

Currently, cells suitable for transport applications typically have an energy density of 100-180Wh/kg, are available at a capacity of 40 Ah/cell, and (with careful thermal and operational management) may achieve 10 years of life in automotive operation. Automotive cells cost ca. $400/kWh but the actual cost of the battery system is higher due to the need for electronic and thermal management. The whole battery system including cells, structural support, thermal management and electronic balance, is called the battery pack. The cost of a battery pack for a pure EV is approximately $800/kWh, i.e. double the cost of the cells alone.

Automotive cells represent only a marginal share (less than 5%) of the rechargeable lithium-ion cells market. The largest market is consumer electronics, such as batteries for laptops and phones. Consumer cells are smaller and have less stringent performance specifications than automotive cells in terms of power, battery life and safety. Small consumer cells cost under 250$/kWh, but these figures do not translate directly to automotive cells because of their more stringent requirements and the engineering challenge of manufacturing large cells.

The United States Advanced Battery Consortium, a collaboration between major U.S. automakers, has a goal of bringing costs down to under $150 per kilowatt-hour to achieve large-scale commercialization of electric vehicles. Battery makers have driven costs down over the last several years, from about $1,000 per kilowatt-hour to $500 per kilowatt-hour for car batteries.

Sakti3 is developing solid-state batteries that do away with the bulky and dangerous liquid electrolytes used in conventional lithium-ion batteries, potentially doubling energy storage. Toyota, which has a joint venture with battery maker Panasonic, is developing solid-state batteries similar to the ones Sakti3 is pursuing.

Lithium Sulfur Batteries

Lithium-sulphur (Li-S) cells are the most advanced metal-S cells. Three main companies are working on their development today: Sion Power/BASF, Samsung, and OXIS Energy. Polyplus used to work on Li-S but sold their patents to Sion Power to concentrate on lithium-air.

Fundamental challenges of Li-S cells to be overcome are the poor rate capacity (i.e. low power), high self-discharge and safety issues with electrolyte stability and use of lithium-metal anode. The loss of capacity is due to the loss of sulphur following the formation of soluble polysulfides that ‘shuttle’ between the electrodes and can eventually lead to deposition of Li2S2 or Li2S at the anode and elsewhere.

Nohms is another company working on lithium sulfur and they think they can get to $100 per kwh

NOHMs technology uses low-cost materials and materials manufacturing methods that are significantly different from traditional lithium-ion. Additionally, NOHMs materials can be seamlessly integrated into our customers’ existing lithium battery manufacturing.

Lithium-sulfur is the only lithium-ion chemistry that could claim less than $100 per kWh manufactured cost and price-parity with lead acid batteries.

Oxis Energy has received 15 million pounds of investment from South African Sasol.

OXIS has successfully developed a patented Polymer Lithium Sulphur (Li-S) based battery technology platform using:

* A Lithium Metal anode

* A Sulphur-based cathode

* A Lithium Sulphide electrolyte rendering inherently safe Lithium Metal

Based on recent progress of Li-sulphur cells and if their life cycle properties were to be improved, a base scenario would see their entry in the car market in 2025 with an energy density of 350Wh/kg, increasing to 500Wk/kg by 2030. A more aggressive scenario would see 300Wh/kg Li-S cells by 2020, increasing to 500Wh/kg by 2030.

Batteries using lithium-air cells have a greater energy density potential (up to 1,000Wh/kg for cells) and are receiving the most R and D of any of the post Li-ion batteries. Lithium-air batteries are used as the only proxy for post-lithium technologies in the long term cost modelling (post 2030).

I think that even with optimistic assumptions it will take a lot for any meaningful penetration of all electric vehicles for several decades. Only by going very light (cars that weight about 1000 lbs) and power electric bikes and scooters can the better batteries close performance and costs gaps.

If you liked this article, please give it a quick review on ycombinator or StumbleUpon. Thanks

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.