Carnival of Nuclear Energy 101 is up at the ANS Nuclear Cafe

Dan Yurman at Idaho Samizdat debunks some new lies related to nuclear power.

Robert Alverez, an energy analyst at the Institute for Policy Studies, is now circulating comments on the Internet that all of the contents of all the spent fuel pools at Fukushima represent a risk to the entire planet. His writings. with this exaggerated description of risk, have been picked up in Japan by Akio Matsumura, who has a wide international following.

Mr. Alverez is not a nuclear engineer. He was an Assistant Secretary for Renewable Energy at the Department of Energy during the Clinton Administration. Since then he has been an “analyst” at the Institute for Policy Studies in Washington, DC, where he writes regularly on energy topics.

One of his favorite rhetorical strategies is to total up the mass of material at a nuclear site and then make the assumption that all of it will blow up through some mysterious and unspecified mechanism spewing its contents far and wide. This is a great stuff for a B- movie on the SciFi channel, like an imaginative idea for a script of Mega-Shark meets Atomic Octopus, but it doesn’t match reality.

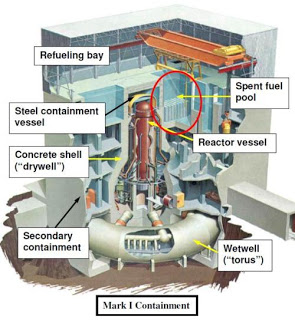

With regard to Spent Fuel Pool #4, it was relatively undamaged by the hydrogen explosion that heavily damaged the non-safety related secondary containment building in March 2011. That is not the primary containment structure which holds the reactor pressure vessel. The concrete and steel structure that holds spent fuel pool #4 rode out the explosion and is not at risk of collapse.

There was no significant damage to the spent fuel pool at unit #4, the fuel, nor was the water level adversely affected by the earthquake, the tsunami, or the hydrogen explosion. Videos of the spent fuel pool show the racked fuel bundles were not affected. They remain in place covered with water.

Current Video shows that the fuel rods are still there

ExxonMobil has a recent history of making big bets that look ill-timed when they make them, but that turn out later to have been made just at the right market inflection point. In 2010, ExxonMobil purchased XTO, a shale gas specialist with expertise in hydraulic fracturing technology, in an “all stock” deal. The deal was originally valued at $41 billion, but later stock market movements discounted Exxon’s value by 15%; the deal was only worth about $36 billion to XTO stockholders.

That deal, even at the bargain price, has not looked so good to analysts for the past few quarters, but ExxonMobil leadership remains positive about the purchase.

My logic question to you is this – do you think Rex Tillerson remains positive about XTO because he believes that natural gas in the United States will continue to sell for 1/8th of the price that it captures in Japan? ($2 per MMBTU at Henry Hub vice $16 per MMBTU as LNG delivered to Japan.) Read the below quote from the Fortune article and tell me if you think ExxonMobil believes that natural gas is going to remain cheap for very long.

Why is Tillerson so confident in the future of natural gas? In December, Exxon released its annual “Outlook for Energy,” which is the company’s view of future demand and consumption trends out to the year 2040. The biggest single theme in the research, which Exxon uses to guide its strategic planning, was the growing demand for electricity. Exxon estimates that worldwide electricity demand will increase 80% by 2040 as hundreds of millions in the developing world achieve a middle-class lifestyle. An increasing amount of that electricity will be generated by natural gas, which will pass coal as the world’s second-largest fuel source, behind crude oil, by 2025.

Exxon has been preparing to meet the emerging demand for natural gas for some time. In Qatar, which has huge natural-gas reserves in its offshore North Field, the company has invested heavily in facilities to produce and export liquefied natural gas, which is supercooled and transported in massive tankers. The company has a $15.7 billion LNG project in Papua New Guinea that will begin supplying gas in 2014 to customers in Asia. And Exxon is also a partner in the massive, Chevron-led, $37 billion Gorgon LNG project in Australia.

Over the next five years Exxon plans to invest $185 billion in its business, most of it to explore for and develop new sources of oil and gas. The cost of the “next barrel” is on the rise, says Tillerson, as easy-to-access reservoirs are depleted.

Nextbigfuture – The Turkish government recently signed a $20 billion project with Russia to build nuclear power facilities in Akkuyu, Turkey. Now the Turkish government has set its sights on constructing a nuclear plant in Sinop, Turkey. The Financial Times recently reported that China is the primary contender for this contract due to its ability to secure financing without requiring guarantees from the Turkish government. Turkish Prime Minister Recep Tayyip Erdogan visited China last week, confirming reports of the deal when Energy Minister Tanir Yildiz held talks with Chinese authorities. At these meetings, Chinese Energy authority Liu Tienan pledged full financial guarantees for the $20 billion project.

Nextbigfuture – This is a review of estimates for a nuclear energy century. 1000 reactors for 2030 would be the high-2030 scenario from the World Nuclear Association (WNA) – Nuclear Century. The WNA lists nuclear generation targets by country.

If you liked this article, please give it a quick review on ycombinator or StumbleUpon. Thanks

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.