Dallas Kachan predicts Greentech for 2011

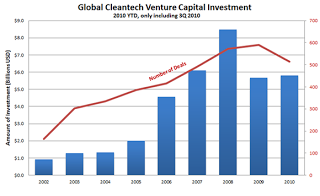

1. Sustained worldwide VC investment in cleantech in 2011

* Kleiner Perkins may be looking to scale back its cleantech investing

* plenty of capital being allocated for cleantech in 2011. Another $500 million has just been announced from the California Public Employees Retirement System (CalPERS). Hony Capital in China is closing in on a new 10 billion RMB ($1.5 billion) fund, and there’s a new €9b ($12.4b) NER300 fund for cleantech in the EU. And that’s just three of dozens announced in the last month.

2. Venture capital will continue to cede importance to corporate and non-institutional capital

3. A return to early stage venture investments

4. Energy efficiency emerges as the clear rock star of cleantech

* There will be failures in 2011 in certain advanced metering companies and other firms engaged in death-by-trials with utilities, and some winners among favorite brands like OPower, EnergyHub, Tendril, Silver Spring, eMeter, AlertMe, Energate.

5. Biofuel investment could reach former highs

6. Nuclear surprises, but not in U.S.

* watch Asia, Europe and Canada as centers of innovation and where trials of new nuclear tech will be performed in 2011. Companies to watch include Thorenco (new reactor designs based on thorium fuel), Thorium One (thorium fuel for existing reactors, trials scheduled to start in existing reactors in 2011), Kurion (glass encasing of nuclear waste), General Fusion and others

NBF Note – the USA has EMC2 Fusion, Lawrenceville Plasma Physics, Hyperion Power Genertion, mPower, Lightbridge

7. Recycling and mining will attract more investment

* BacTech Mining (CVE:BM), Simbol Materials, Buss & Buss Spezialmetalle, DeMetai Technologies, MBA Polymers and GFL Waste & Recycling (which just got a$100m private equity infusion) are examples of companies that could benefit from commodity prices that will continue to rise in 2011.

8. Natural gas emerges to threaten solar and wind for utility renewable power generation

* what if chemically identical natural gas (not just messy syngas) could be made inexpensively from practically free feedstock? Such gas, if indistinguishable from petro-based natural gas, could be transported in existing pipelines and sold at a premium to industrial customers like power utilities anxious for a cheaper renewable source than solar and wind.

9. China becomes the most important market for cleantech: if you’re not selling in China, you won’t matter

If you liked this article, please give it a quick review on ycombinator or StumbleUpon. Thanks

Featured articles

Ocean Floor Gold and Copper

Ocean Floor Mining Company

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.