Financial News has calculated that the steep climb in asset values last year will have produced an increase of this order, which is 37% higher than the annual 8% growth rate achieved over previous years.

The Spectrem Group shows that the number of households in the U.S. worth $5 million or more rose 23% in 2006, to a record 1.14 million — passing the million mark for the first time. This is likely up to 1.3 million in 2007.

The Federal Reserve Board, relying on its own surveys of consumer finance, says in [2006] there were 1.4 million households worth [$5 million]. Why is Spectrem’s number lower? Because its survey doesn’t include primary residences in calculating net worth, while the Fed does.

The group says in 2006 there were now 9 million households in the U.S. worth $1 million or more, while the number of affluent households — those with $500,000 or more — grew to 15 million in 2006, up 9% from 2005.

How much money does it take to be considered “rich” today?

The SEC has proposed a new definition for “accredited investor” — someone rich enough to invest in private investment pools without needing protection from government regulators. To invest in hedge funds today, investors need to have $1 million in net worth (including the value of their primary residence), or income of at least $200,000 for individuals or $300,000 for households. The SEC has proposed raising the bar, requiring investors to have $2.5 million in investible assets.

A Speed dating group has their definition of rich as well.

| Age | Salary |

| 25 or below | $200,000+ |

| 26 to 30 | $300,000+ |

| 30+ | $500,000+ |

If they don’t need salaries, invested assets of $1 million or more or a trust of $4 million or more will count.

A SmartMoney article disputes the advice of the millionaire next door (book) The Millionaire next door talks about saving taking little risk to become a millionaire when you are quite old.

Smartmoney.com’s take:

To enter the nation’s top 1%, you need more than $5 million. And if you get there, you’ll have plenty of newly-arrived company: The number of U.S. “pentamillionaires” has quadrupled in the past 10 years, to more than 930,000. Indeed, 70% of the nation’s big family fortunes are less than 13 years old, according to research and marketing firm The Harrison Group. And the people who amassed them are, first and foremost, entrepreneurs — risk takers for whom wealth is a byproduct of pursuing their passion. The vast majority (of newly wealthy people) — 80% — either started their own business or worked for a small company that saw explosive growth.

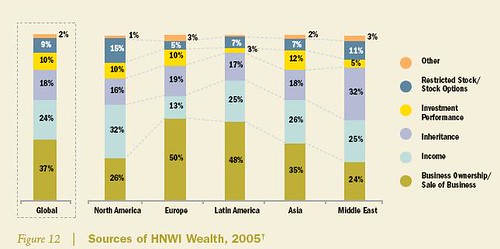

The Merrill Lynch and Cap Gemini Wealth report lists business ownership sale as the top source of wealth, then income (high salary and savings), then inheritance and then investment performance (ie stock trading or buying and selling real estate) and stock options. In the USA, the main source is income.

FURTHER READING:

Projecting future wealth

Household income distribution in the USA from wikipedia

Affluence and extreme affluence in the USA from wikipedia

Worldwide distribution of household wealth

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.